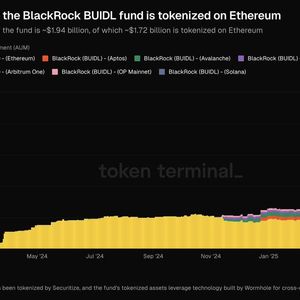

BlackRock's tokenized U.S. Treasury fund, known as BUIDL, has experienced substantial growth, reaching a market cap of approximately $1.9 billion. This figure represents a near doubling in value over the past month. BUIDL now accounts for 34% of the tokenized U.S. Treasury market, positioning it behind only four stablecoins in terms of tokenized dollar assets. In March, the fund set a record by distributing an estimated $4.17 million in dividends, marking the largest monthly payout for any tokenized Treasury fund. Of this total, $3.5 million was distributed on the Ethereum network, which constitutes about 88.76% of the fund's assets under management (AUM). Overall, the total AUM of the BUIDL fund is approximately $1.94 billion, with around $1.72 billion tokenized on Ethereum. However, the broader real-world asset (RWA) sector has faced challenges, with a 14% drop in market cap, amounting to a loss of $7.4 billion amid tariff uncertainties. This is an AI-generated article powered by DeepNewz, curated by The Defiant. For more information, including article sources, visit DeepNewz . To continue reading this as well as other DeFi and Web3 news, visit us at thedefiant.io