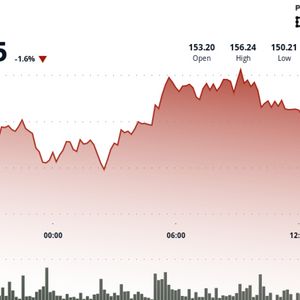

Solana's on-chain fundamentals gained a major vote of confidence on Thursday as Florida-based DeFi Development Corp (DFDV) announced it had expanded its SOL SOL treasury by acquiring 17,760 additional tokens. The purchase, valued at approximately $2.72 million, was executed at an average price of $153.10 per token. This move aligns with the company’s stated long-term strategy of compounding SOL holdings and staking rewards. Following this acquisition, DeFi Dev Corp's total holdings reached 640,585 SOL and SOL equivalents, representing a U.S. dollar value of around $98.1 million. Based on the company’s last reported total of 14,740,779 shares outstanding, the current SOL-per-share (SPS) stands at 0.042, or roughly $6.65 per share using the day’s price data. All newly acquired SOL will be staked with a variety of validators, including DeFi Dev Corp’s own infrastructure on the Solana network. This approach enables the company to earn native yield through staking rewards and validator fees, while directly contributing to Solana’s decentralization and operational resilience. DeFi Dev Corp has positioned itself as the first public company to make Solana the centerpiece of its treasury strategy. In addition to accumulating and staking SOL, it is also actively engaged in decentralized finance (DeFi) opportunities and ecosystem participation. The company’s treasury strategy offers shareholders direct economic exposure to the token while supporting Solana’s application-layer development. At the time of writing, SOL was trading at around $150.75, down 1.6% in the past 24-hour period, according to CoinDesk Research's technical analysis model. Meanwhile, the broader crypto market, as gauged by the CoinDesk 20 Index (CD20), is up 0.13% in the same period. Technical Analysis Highlights SOL ranged from $156.28 to $150.04 between July 2 17:00 and July 3 16:00, reflecting 4.15% volatility. Strong resistance formed at $156 during early trading hours, with above-average volume triggering a reversal. Price dropped below key support at $152 during the 12:00–15:00 period, settling at $150.44. In the final hour (15:16–16:15 UTC), SOL declined 0.63% from $151.85 to $150.89. A sharp selloff occurred at 15:35 UTC, with price dropping to $150.44 on high volume (213.6K). Support emerged at $150.35 with increasing buy-side activity and a modest recovery in the final minutes. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy .