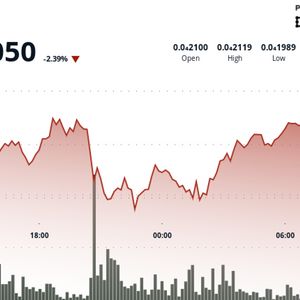

BONK navigated sharp swings over the last 24 hours, fluctuating between $0.00001991 and $0.00002123 , a 45% trading spread that underscored heightened volatility. Selling pressure intensified late on Tuesday amid a scheduled $11.41 million token unlock , with the token dropping from $0.00002102 to a low of $0.00001991 at 21:00 UTC. This move was accompanied by a volume spike surpassing 1.15 trillion tokens, according to CoinDesk Research's technical analysis data model. Despite the decline, BONK rebounded at the $0.00001990 support level. By the start of the European morning Tuesday, the token had recovered to $0.00002056, consolidating within a narrower range and signaling potential stabilization after the selloff. Investor focus remains on Safety Shot’s $30 million financing deal , in which $25 million was funded through BONK tokens, a landmark move as the NASDAQ-listed company became the first to add the meme coin to its treasury. Technical Analysis BONK traded in a 45% range between $0.00001991 and $0.00002123. Heavy selling Sept. 1 drove volume to 1.15 trillion tokens between 20:00–21:00 UTC. Support held at $0.00001990 amid strong institutional buying interest. Recovery saw price climb from $0.00002035 to $0.00002056 on Sept. 2. Resistance identified near $0.00002120 as sellers capped further upside. Short-term volatility narrowed to a 0.24% spread around $0.00002053–$0.00002058. Volume spikes above 27.3 billion tokens at 09:50 UTC suggested continued accumulation. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy .