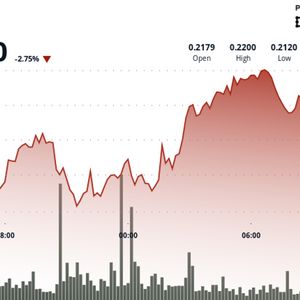

HBAR saw heightened volatility over the 24-hour period from Sept. 1, 09:00 to Sept. 2, 08:00, trading within a $0.013 range that marked a 6% intraday swing between $0.21 and $0.22. The token initially slipped from $0.22 down to support at $0.21, weighed by a surge in liquidation volumes that spiked above 79 million. However, as selling pressure subsided, HBAR mounted a recovery, closing the session back near the $0.22 level. Market activity suggested that bearish momentum lost steam once the $0.21 level was tested, with declining volumes on the rebound signaling a potential shift toward sustained upward momentum. The trading action underscores a near-term technical structure where resilience at key support levels has kept bullish prospects intact. The emphasis on real-world applications is positioning Hedera and other enterprise-focused blockchains at the forefront of investor attention. Alongside Hedera, projects such as Kaspa and Remittix are building momentum by targeting scalability and cross-border payments, respectively. With payments innovation resurging as a driver of crypto adoption, Hedera’s corporate alliances and technological architecture put it in a strong position to benefit from the market’s pivot toward utility-driven blockchain infrastructure. Technical Indicators Assessment Trading bandwidth of $0.013 representing 6 per cent differential from session nadir of $0.21 to apex of $0.22. Volume surges exceeding 79 million during initial decline phase. Critical support threshold examined near $0.21 before recuperation. Diminishing liquidation pressure in concluding trading hours. Recovery momentum elevating prices towards $0.22 resistance. Exhaustion of bearish impetus indicated by volume patterns. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy .