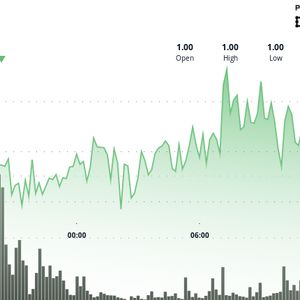

USDC at Center of Major Financial Developments Global economic tensions and shifting trade policies are creating subtle ripples in the stablecoin market, with USDC experiencing minor volatility while maintaining its dollar peg. The stablecoin recently navigated a brief dip below parity before quickly recovering, demonstrating resilience amid broader market uncertainty as investors seek safe havens during geopolitical instability. Circle's IPO filing has revealed unprecedented insights into the stablecoin ecosystem, including the surprising arrangement where Coinbase receives half of USDC reserve revenue. With major banks JPMorgan and Citibank backing Circle's public offering targeting a $4-5 billion valuation, the move signals growing institutional confidence in regulated stablecoins despite ongoing trade disputes affecting traditional markets. As geopolitical tensions escalate, exchanges like Binance are reporting record stablecoin deposits, with USDC playing a crucial role in derivative trading markets. The stablecoin's stability has made it particularly attractive during recent market volatility, with trading volumes peaking during transition phases as investors seek protection from economic fallout related to international trade conflicts. USDC Technical Analysis Highlights USDC maintained a narrow trading range of 0.000829 (0.083%) with an annualized volatility of 1.58%. Price action showed a gradual decline from 1.0006 to sub-parity levels around March 31st. A clear support zone formed at 0.9999, with trading volumes peaking during the transition phase. Recent price action shows a modest recovery trend with increasing buying pressure. Higher lows and consistent volume patterns above 50M units hourly suggest renewed confidence. A brief dip below parity (0.9999) between 09:53-09:57 marked the first sub-parity trades during the session. Increased trading volumes peaked at 4.1M units at 09:56 during volatility Buyers stepped in decisively to defend the peg, resulting in a stabilization of around 1.0000. Disclaimer: This article was generated with AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk’s full AI Policy . This article may include information from external sources, which are listed below when applicable. External References: Cryptopolitan, “ Binance Draws In a Record Inflow of Stablecoins ,” accessed Apr. 3, 2025 CryptoNews, “ Coinbase Receives 50% of Circle’s USDC Reserve Revenue, IPO Filing Reveals ,” accessed Apr. 3, 2025 BitcoinWorld, “ Circle IPO Eyes $5B Valuation Backed by USDC Stability ,” accessed Apr. 3, 2025 CryptoNews, “ Stablecoin Issuer Circle Files for IPO ,” accessed Apr. 3, 2025 The Coin Rise, “ Circle Files for NYSE Listing Amid Surging Stablecoin Revenue: Details ,” accessed Apr. 3, 2025