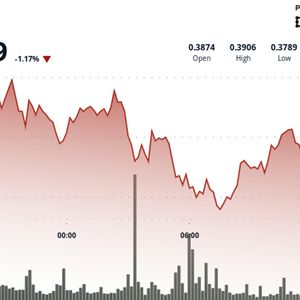

Stellar’s native token XLM experienced heightened volatility over the past 24 hours, fluctuating between $0.38 and $0.39 — a 3% range — before closing near session highs. After dipping to $0.38 early on Oct. 8, the asset mounted a swift recovery, regaining ground above $0.39 by the end of the period, suggesting robust buying activity at lower levels. During the most recent hour of trading, XLM again demonstrated pronounced short-term swings, plunging briefly to $0.38 before rebounding sharply to reclaim the $0.39 mark. This intraday reversal underscores a strong recovery pattern, hinting at increasing market momentum and potential continuation of the upward trajectory. Institutional activity appears to be reinforcing Stellar’s resilience. Open interest has climbed beyond $300 million, reflecting rising participation from professional traders and funds. As an ISO 20022-compliant cryptocurrency, XLM is seen as strategically positioned for upcoming Fedwire and SWIFT upgrades in 2025 — a narrative driving institutional confidence in the network’s role in global payments. Sustained accumulation around $0.38 suggests that large buyers are taking advantage of temporary pullbacks, with surging volumes confirming renewed interest in Stellar’s cross-border payment infrastructure. Consolidation near $0.40 signals the market’s growing conviction that XLM’s recovery could extend further as payment-focused digital assets gain mainstream traction. Technical Indicators Signal Bullish Momentum Volume analysis reveals heightened selling pressure during the early morning hours of 8 October, with trading activity culminating at 52.49 million during the 06:00 hour, considerably above the 24-hour average of 27.43 million. Robust volume support established around the $0.38-$0.38 zone during the decline phase. Volume surges during decline phases, particularly the 1.54 million surge at 13:28 and subsequent high-volume periods, confirmed institutional accumulation at reduced levels. Quintessential support and resistance dynamics emerged with substantial purchasing interest around the $0.38-$0.38 zone. Sustained upward momentum concluded with XLM achieving new session peaks proximate to $0.39. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy .