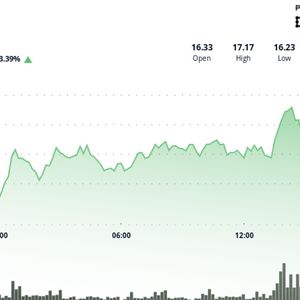

The price of LINK (LINK), native token of oracle provider Chainlink, climbed 4% on Monday extending its rebound from late last week's crypto carnage. The token hit $17 during the session, up nearly 10% from the weekend lows, CoinDesk data shows. The move occurred as Chainlink rolled out market data feed for U.S. Equities and ETFs, aiming to connect traditional financial instrument with on-chain capital markets. Chainlink Data Streams now provide "real-time, high-throughput pricing" for assets such as SPY, QQQ, NVDA, AAPL, MSFT, and other instruments across 37 blockchain networks, according to a blog post. The feature enables use cases such as tokenized stock trading, perpetual futures and synthetic ETFs on blockchain rails. Solana-based DeFi protocol Kamino and decentraliized perpetuals trading venue GMX have already started using the service, according to the post. "This is a significant leap forward for tokenized markets — closing a critical gap between traditional finance and blockchain infrastructure," Johann Eid, Chief Business Officer at Chainlink Labs, said in the post. Technical Analysis Shows Strong Momentum LINK exhibited remarkable bullish performance throughout the 24-hour trading session, climbing from $16.16 to $16.87 and delivering a substantial 4.39% gain, according to CoinDesk Research's technical analysis model. The persistent upward momentum, distinguished by progressively higher lows and consistently above-average volume during rally phases, indicates sustained bullish market sentiment with strong potential for additional gains targeting the $17.00 psychological threshold, the model said. Technical Indicators Normal support established at $16.11 representing the initial session low during the 24-hour period. High-volume support confirmed at $16.29 during the midnight UTC surge with significant trading activity. Key resistance formed at $16.87 with strong volume confirmation and multiple test attempts. Volume spike to 1,533,754 units during the 4 August 13:00 hour, nearly triple the average volume. Breakout pattern confirmed from $16.65 to $16.83 establishing critical resistance turned support level. Higher lows pattern maintained throughout the rally indicating sustained bullish momentum. Volume confirmation above 30,000 units during key rally phases supporting upward price action. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy .