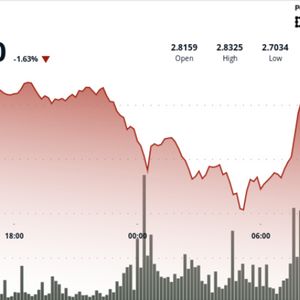

Token trades between $2.70–$2.84 in Aug. 31–Sept. 1 window, with whale accumulation countering heavy resistance at $2.82–$2.84. News Background XRP fell from $2.80 to $2.70 during late Aug. 31–early Sept. 1 before rebounding to $2.82 on heavy volumes. Whales accumulated 340M XRP over two weeks , a signal of institutional conviction despite short-term bearish pressure. On-chain activity spiked with 164M tokens traded during the Sept. 1 morning rebound , more than double session averages. September remains a historically weak month for crypto, but whale accumulation is viewed as a counterbalance to retail liquidation flows. Price Action Summary Trading range spanned $0.14 (≈4.9%) between $2.70 low and $2.84 high. The steepest decline came at 23:00 GMT on Aug. 31, as price slid from $2.80 to $2.77 on 76.87M volume , nearly 3x daily averages. At 07:00 GMT Sept. 1, bullish flows drove a rebound from $2.73 to $2.82 on 164M volume , cementing $2.70–$2.73 as near-term support. Final hour consolidation (10:20–11:19 GMT) saw price slip 0.71% from $2.81 to $2.79, with heavy selling between 10:31–10:39 on 3.3M volume per minute , confirming resistance at $2.80–$2.81. Technical Analysis Support : $2.70–$2.73 floor repeatedly defended, reinforced by whale buying. Resistance : $2.80–$2.84 remains the rejection zone, with $2.87–$3.02 as the next upside threshold. Momentum : RSI near mid-40s after rebound, showing neutral-to-bearish bias. MACD : Compression phase continues; potential crossover if accumulation persists. Patterns : Symmetrical triangle forming with volatility compression; breakout path remains open toward $3.30 if resistance clears. What Traders Are Watching If $2.70–$2.73 holds, short-term traders will treat it as a springboard for $2.84 retests. A close above $2.84 would put $3.00–$3.30 back in play. Downside scenario: breach of $2.70 exposes $2.50 as next structural support. Whale accumulation vs. institutional selling — the push-pull dynamic that could dictate September direction.