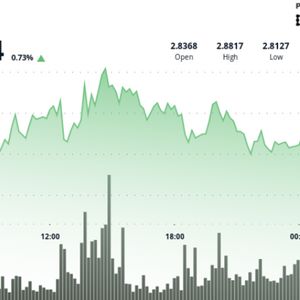

News Background XRP traded in a narrow 2% range from $2.81 to $2.87 during the 24h session from Sept. 2 at 14:00 to Sept. 3 at 13:00. Large wallets accumulated roughly 340M XRP (~$960M) over the past two weeks even as institutions liquidated ~$1.9B since July. Total transaction volume across the XRP Ledger reached 2.15B XRP on Sept. 1 , more than double typical daily activity. Analysts remain split: some highlight long-term bullish structures (symmetrical triangles, Elliott Wave counts) with upside toward $7–$13 , while others warn of fading momentum below multi-year resistance trendlines. Price Action XRP opened near $2.84 and closed at $2.85 , up slightly despite intraday volatility. Price dipped early from $2.84 → $2.79 , then rebounded to $2.87 by midday on Sept. 3. Support developed at $2.82 , repeatedly attracting bids. Resistance capped upside near $2.86 , where distribution pressure intensified. Final-hour trading saw a reversal: a spike to $2.873 (12:38 GMT) on 5.38M volume was rejected, pushing price back under $2.85. Technical Analysis Support: $2.82 zone remains the key demand area. Below that, $2.70 and $2.50 are next. Resistance: $2.86–$2.88 continues to act as overhead supply. $3.00 is the psychological hurdle, with $3.30 as breakout confirmation. Momentum: RSI steady in mid-50s, showing neutral bias with slight bullish lean. MACD: Histogram converging toward bullish crossover, signaling momentum could strengthen if volume persists. Patterns: Symmetrical triangle consolidation under $3.00 intact. Break above $3.30 unlocks higher targets. Volume: Session surges (93M–95M vs 44M avg) point to active institutional flows. What Traders Are Watching Whether $2.82 support holds under renewed pressure. A decisive close above $2.86–$2.88 , then $3.00 and $3.30 for a breakout setup. Whale flows: continued accumulation versus ongoing institutional selling. Regulatory and macro catalysts, including Fed policy and pending SEC clarity, which could shift sentiment quickly.