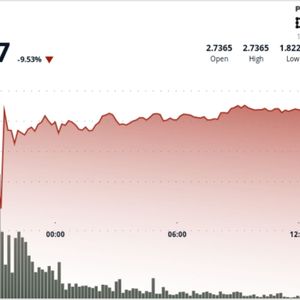

XRP clawed back losses in Friday’s chaotic trade, rebounding from a 41% collapse to close above $2.47 as institutional bids rebuilt following panic liquidations. The session’s $1.14 range — from $2.77 down to $1.64 — was one of the widest in XRP’s 2025 trading history, driven by macro-led deleveraging and heavy futures liquidations across major venues. What to Know • XRP fell from $2.77 to $1.64 between Oct 10 16:00 – Oct 11 15:00, marking a 41% intraday collapse before rebounding to $2.49. • Over $150 million in XRP futures were liquidated as Trump’s 100% tariff announcement triggered cross-asset risk aversion. • Intraday volume topped 817 million — nearly triple recent daily averages — as volatility peaked at 41%. • Institutional accumulation seen between $2.34–$2.45 as large holders rebuilt exposure on the bounce. • Key resistance remains $3.05 with upside projections toward $3.65–$4.00 if recovery momentum sustains. News Background The sudden macro shock — new U.S.–China tariffs — triggered forced unwinds across risk assets. XRP briefly plunged to $1.64 before stabilizing as volume-weighted bids absorbed panic sales. Derivatives data confirmed capitulation: open interest fell 6.3% overnight while long liquidations outpaced shorts 15:1. Analysts framed the rebound as “institutional recalibration” rather than retail-driven volatility, with treasuries adding spot exposure in the $2.40 zone amid ETF inflows and improving sentiment around Ripple’s banking integrations. Price Action Summary • The steepest drawdown hit 19:00–21:00 UTC as XRP dropped $1.08 on 817 million volume — capitulation candle of the week. • Immediate rebound to $2.34 created new base; price then climbed steadily to $2.49 by 15:00 UTC. • Final hour (14:58–15:57) saw a $0.03 band ($2.46–$2.49) with volume of 2.2 million — evidence of consolidation, not exit flows. • Market structure rebuilt with $2.47–$2.48 as short-term support, confirming absorption of earlier volatility. Technical Analysis • Support – $1.64 holds as capitulation low; $2.40–$2.45 forms accumulation floor. • Resistance – $3.05 remains breakout trigger; close above signals structural recovery. • Volume – 817 million vs 30-day avg ≈ 270 million — capitulation-grade turnover. • Pattern – Bullish recovery channel developing; momentum indicators turning positive above $2.47. • Trend – RSI recovered from oversold; MACD histogram flips toward zero, showing early reversal bias. What Traders Are Watching • Whether $2.47 zone holds as confirmed support through weekend Asia sessions. • Continuation bids from institutional desks post-liquidation phase. • ETF-related flow data following the 21Shares TDOG launch spillover. • Technical break above $2.90–$3.00 to re-enter long setups targeting $3.65+. • Macro-risk narrative — follow-through from tariff escalation and crypto correlation spikes.