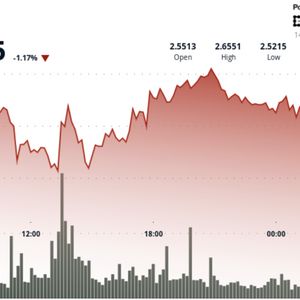

Aggressive selling near $2.66 resistance and a major Binance inflow signal short-term distribution while volume data show institutional dip-buying defending $2.55. News Background XRP’s rebound from Friday’s sub-$1.58 liquidation lows lost steam overnight as fresh whale activity hit exchanges. A single 23.9 M XRP transfer (≈ $63 M) to Binance coincided with selling pressure that erased early gains. The move came as open interest jumped 2.4 % to $1.36 B, suggesting leveraged positioning remains elevated even after the $32 B market-cap recovery that followed Trump’s tariff-driven crypto rout. Broader risk markets stabilized as trade-war rhetoric softened, but derivatives desks flagged renewed short build-ups near $2.65–$2.66. Price Action Summary XRP traded a $0.11 band (4 %) from $2.54 to $2.66 between Oct 13 05:00 and Oct 14 04:00. Volume exploded to 244.6 M at 13:00 — nearly 3× the 91.8 M average — confirming aggressive dip-buying near $2.55. Price peaked at $2.66 during 20:00 hour before sustained sell-off drove a $2.55 close. Bears extended control into the final hour, breaking $2.57 support on 4 M volume at 04:10, then consolidating $2.55–$2.56 into close. Technical Analysis The $2.55–$2.56 zone continues to anchor near-term support after repeated high-volume defenses. Resistance is firm at $2.65–$2.66 where profit-taking and whale flows triggered multiple rejections. Momentum bias leans bearish while XRP trades below its 200-day MA ($2.63), though a sustained reclaim above $2.60 could reset the structure for another $2.70 test. Volume remains the key tell: spikes on dips show institutions buying weakness, but lower highs suggest supply still outweighs demand. What Traders Are Watching $2.55 support — can it hold through weekend Asia sessions? Reaction to $2.65–$2.66 resistance zone on next uptick. Binance whale flows as a signal of continued distribution or rotation. Leverage unwind potential if open interest ($1.36 B) stays elevated.