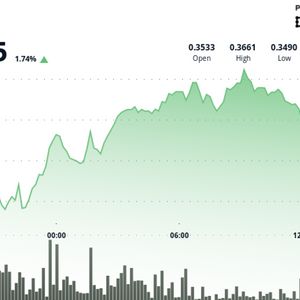

Stellar Lumens (XLM) extended its recent rally over the past 24 hours, climbing 3% as buyers absorbed heightened selling pressure and pushed the token into fresh resistance levels. Between Sept. 1 at 15:00 UTC and Sept. 2 at 14:00 UTC, XLM advanced from $0.36 to $0.36, with volatility of 5% underscoring active participation. The asset found support at $0.35 following a brief wave of selling before consolidating in the $0.36 range. Resistance emerged around $0.37, where the market saw two rejection points, though trading volumes above the daily average of 31.2 million tokens signaled sustained institutional interest. The bullish structure carried into the final hour of the session, when XLM gained 2% from $0.36 to $0.37. The move was bolstered by a volume spike of 2.7 million units at 14:00 UTC, enabling the token to briefly pierce the $0.37 ceiling before stabilizing above $0.36. The breakout reinforced the 24-hour trend and suggested buyers are building a foundation for further upside if volume momentum continues. At the same time, leading South Korean exchanges Bithumb and Upbit said they will suspend XLM deposits and withdrawals beginning Sept. 3 at 09:00 UTC. The move is part of preparations for Stellar’s Protocol 23 upgrade, which aims to modernize network infrastructure and expand interoperability. Protocol 23 has been framed as a step toward broadening Stellar’s utility for real-world assets, of which roughly $460 million are already circulating on the network. The synchronization of price gains with network enhancements highlights a growing narrative of enterprise adoption. CoinDesk Data's technical analysis model note that the consolidation above $0.36, combined with systematic accumulation around key support levels, points to ongoing institutional positioning that could pave the way for a sustained move beyond $0.37. Market Analysis Reveals Strengthening Corporate Interest Price established fundamental support at $0.35 during heightened selling pressure on September 1, 21:00. Robust accumulation activity developed between $0.36-$0.36 following decisive market recovery. Resistance parameters identified at $0.37-$0.37 where price encountered dual rejection events. Trading volume increases above 24-hour average of 31.20 million validated institutional market participation. Asset maintaining consolidation within ascending price channel formation. Breakout potential above $0.37 resistance dependent upon sustained volume validation. Trading momentum accelerated during 13:35-13:46 session with decisive upward movement. Enhanced support structure established around $0.36-$0.36 price levels. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy .