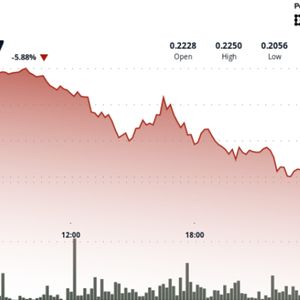

What to Know DOGE dropped 8% from $0.22 to $0.21 between 03:00 on July 31 and 02:00 on August 1, marking one of the steepest daily declines this month. The price action unfolded within a wide $0.03 range—between a peak of $0.23 and a low of $0.20—amid heavy resistance at the upper bound and capitulation near the session close. Volumes spiked sharply during the final hours of the session, particularly at midnight, where trading surged to 1.25 billion DOGE—well above the 24-hour average of 365 million. The move suggests heightened liquidation activity, likely triggering cascading sell orders across leveraged positions. News Background • DOGE fell 8% over 24 hours as volume surged to 1.25 billion during overnight trading. • Resistance at $0.23 held firm despite early upside attempts, while $0.21 emerged as short-term support. • Institutional wallets acquired 310 million DOGE during the correction, signaling accumulation during weakness. • Bit Origin added 40 million DOGE to its treasury as part of a $500 million corporate diversification program. • Broader crypto markets remain pressured by macroeconomic uncertainty, with inflation and rate path ambiguity clouding short-term sentiment. Price Action Summary DOGE tested $0.23 around 09:00–10:00 on July 31 but failed to sustain momentum. Selling accelerated through the afternoon and into the evening, with the largest single-hour drop occurring just after midnight. Price hit a low of $0.20 before stabilizing near $0.21, where it found repeated short-term support. In the final 60-minute session (01:08–02:07 on August 1), DOGE rebounded slightly from $0.21 to $0.21, logging a modest 1% gain. The move, while limited, came on relatively balanced volume and suggests short-term stabilization. The rejection near $0.21 resistance and narrowing price band indicate potential exhaustion of selling pressure in the immediate term. Technical Analysis • 8% decline from $0.22 to $0.21 with a wide $0.03 range between high and low. • Resistance at $0.23 confirmed after failed breakout attempts. • Support near $0.21 held multiple times during final hour, showing signs of accumulation. • Volume peak at 1.25 billion around midnight—a near 3x increase over the daily average. • Price action narrowed into a tight $0.21–$0.21 band post-recovery, signaling potential base formation. What Traders Are Watching • Whether DOGE can sustain its footing above the $0.21–$0.20 support range in coming sessions. • Signs of follow-through accumulation from wallets that acquired during the selloff. • Macroeconomic signals—including U.S. inflation commentary and Asian equity risk sentiment—that could influence broader crypto appetite. • Reaction to DOGE's inclusion in Bit Origin’s strategic allocation and potential future treasury demand catalysts.