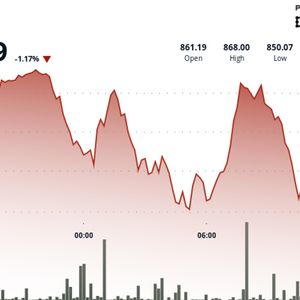

The price of BNB saw sharp intraday swings over the past 24-hour period as it continued to drop from an all-time high of $900 seen late last month. Over a 24-hour window, the asset traded between $849.88 and $868.76, a 2% move that began with bullish momentum but ended with signs of fatigue near resistance. The volatility follows filings with the U.S. Securities and Exchange Commission by REX Shares late last month, along with the rise of BNB-focused treasury firms. The latest, B Strategy, aims to hold up to $1 billion worth of BNB with backing from the investment firm led by Binance co-founders Changpeng Zhao and Yi He. While BNB failed to hold on to its gains from earlier, underlying network activity surged. Daily active wallet addresses on BNB Chain more than doubled, climbing to near 2.5 million according to DeFiLlama data. Yet, transaction volumes have been dropping steadily since late June, data from the same source shows. BNB’s price drop also comes ahead of key economic data from the U.S. this week, including surveys of manufacturing and services and August payroll figures. Jobs data could influence the odds of the Federal Reserve cutting interest rates this month. As it stands, the CME’s FedWatch tool weighs a near 90% chance of a 25 bps cut, while Polymarket traders put the odds at 82%. Technical Analysis Overview BNB entered the session with a surge from $860.30 to $868.08, but the rally quickly lost steam. Heavy selling pressure emerged around the $867–$868 level, a zone that has now established itself as a key resistance ceiling, according to CoinDesk Research's technical analysis model. Volume surged during this attempt, peaking at 72,000 tokens, well above the average of 54,000, indicating a high level of participation during the failed breakout. After the rejection, BNB retraced toward the $850–$855 range, where buying interest emerged. This was most visible as the token dipped to $851.40, triggering a volume spike. This response pointed to solid demand at these lower levels. Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards . For more information, see CoinDesk's full AI Policy .