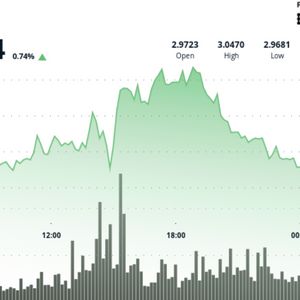

XRP spiked to $3.05 on doubled turnover before fading into consolidation, with whales offloading more than $300M as institutional desks repositioned ahead of a pivotal Fed decision. The $2.99 floor held on repeated defenses, leaving price boxed between $2.99 and $3.05 while ETF deadlines and rate speculation loom. News Background XRP gained 3% in the 24 hours to Oct. 7, trading between $2.97 and $3.05 before closing near $2.99. The move was driven by a surge in institutional flows — over 1.5B tokens transacted — and whale disposals exceeding $300M. Macro catalysts dominated sentiment. Markets now price a 96% chance of a Fed rate cut on Oct. 29, while 70+ ETF applications, including seven for XRP, face SEC deadlines starting Oct. 19. Price Action Summary XRP’s session range spanned $0.08 (3%), from $2.97 low to $3.05 high. Afternoon rally lifted price from $3.00 to $3.04 on 137M turnover, nearly 2x the daily average. Repeated rejection at $3.04–$3.05 confirmed resistance. Price consolidated around $2.99, where buyers stepped in multiple times. A late flush to $2.981 was absorbed quickly, with volume spikes of 2.2M creating a short-term floor. Technical Analysis Resistance remains entrenched at $3.04–$3.05, where heavy selling capped the advance. Support is validated at $2.99, reinforced by multiple retests and absorption of intraday liquidation flows. The price structure suggests accumulation at the $2.99 base, with a potential bullish continuation if momentum can retake $3.03 and challenge $3.05. Breakout through this resistance could set up targets toward $3.10, though macro catalysts remain the dominant driver. What Traders Are Watching? Whether $2.99 holds as a firm support base under continued whale distribution. If institutional positioning sustains momentum into the Oct. 19 SEC ETF deadlines. Market reaction to Fed policy signals — a cut could lift flows across risk assets. Confirmation of breakout above $3.05 to unlock the next leg toward $3.10–$3.12.